A 401(k) is the main retirement savings vehicle for the majority of employees. In fact, over 66% save less than 10% of their annual income. You, the employer, are a critical factor in the retirement health of your employees. Having the best 401(k) possible is now mandatory.

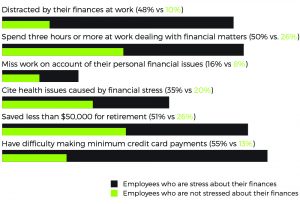

Financial stress is the leading cause of absenteeism, reduced productivity, job hopping, divorce, health issues and much more. Having a strong 401(k) with financial wellness can have a great impact on your employees.

But, your 401(k) may be suffering from one or more of these common problems: 1) high administrative costs, 2) limited investment options, 3) high expense mutual funds, 4) no financial education for your employees, 5) closed/limited platform, 6) poor user interface and access.

These issues are pervasive in all the plans we see. As the fiduciary on the plan, you are responsible for the proper and best interest administration of the plan. High administration and custodian fees are eroding your company’s bottom line. Above all, your employees may be suffering the most, as high fees remove retirement dollars from their pockets. A lack of education and professional portfolio management can also cause them to make poor investment decisions. Our simple, elegant solution can help you tackle these constraints.

FINANCIAL PROBLEMS LEAD TO EMPLOYEE STRESS

Savings, particularly a 401(k), is a deferred experience. Money has no value until its converted to lifestyle. The structure of your 401(k) plan has a direct impact on the future lifestyle of many of your employees.

Employer benefit plans routinely miss the needs/wants of employees. Saving for retirement and reducing stress are in top category for surveyed employees. Having a great 401(k) plan with financial education addresses several key areas.

IMPACT OF FEES ON EMPLOYEE ACCOUNTS

These issues are pervasive in most existing 401(k) plans. As the fiduciary on the plan, you are responsible for the proper and best interest administration of the plan. High administration and custodian fees are eroding your company’s bottom line. Above all, your employees may be suffering the most, as high fees remove retirement dollars from their pockets. A lack of education and professional portfolio management can also cause them to make poor investment decisions. This simple, elegant solution can help you tackle these constraints.

ENTER FUTURE401K

- Low cost – Powerful benefits

- Invst acts as your fiduciary partner

- Improved plan design structured to increase participation

- WealthFIT – financial wellness and education program

- Researched and tested investment line-up

- Cutting edge technology platform – easy to use and access for all participants

The last thing any company wants to do is take on a change in their 401k plan. What a pain! It doesn’t have to be that way. Our enrollment process is simple, online, and clearly delivered to your employees. In fact, this is an opportunity for you to communicate the real benefit of your new plan and financial education commitment to your employees.

ARE YOU REACHING YOUR FULL FINANCIAL POTENTIAL? READY TO LIVE THE LIFE YOU WANT TO LIVE?

If you died today, what would your tombstone say? Would it be complete, or would there be much left unsaid? Now, if we could extend your life, what would you change? What more could you accomplish? What would be the culmination of your life that people would remember?

“The world moves fast. And when the only constant is change, how you adapt to that change determines your success or failure.” – Scott Jarred, CEO